Nihon Hustle

PayPal Xoom MOney Transfer Review [New for 2021]

Nihon Hustle is reader-supported. When you buy through links on our site, we may earn a commission.

Evaluating Xoom for Your Next International Money Transfer? This Review Should Help you Decide.

by Doc Kane

Updated: June 14, 2021

Need to send money in a hurry, but have time to verify your identity? PayPal Xoom might be the money transfer service right for you. Particularly if you need to transfer money to the Philippoines or Mexico.

In contrast to Western Union’s more than 150 year history, Xoom has only been operating in the international money transfer business since 2001, and yet in that time, they have become a formidable player.

As mentioned above, Xoom does a lot of business with banks in Mexico and the Philippines, and the two countries account for the largest among money transfers sent using the platform on the whole.

I’ve personally used Xoom in the past to transfer various sums of money for freelance editing services when I worked with an editor who lived in Manilla—things always went off without a hitch.

Today Xoom is owned by omnipresent PayPal, which provides it with an even greater degree of perceived security and breadth of services.

If you live in Japan as I do, it’s not currently possible to send money from Japan using Xoom, but you can use Xoom to send money to Japan.

What are the benefits of using Xoom to transfer money internationally?

1. Xoom’s In-Person Locations

In many places throughout the world, the banking system structure is often slanted toward in-person transactions.

To combat this, remittance companies like Remitly and Xoom have partnered with numerous banks to allow for smooth cross-border banking.

Regulations often involve a significant amount of paperwork to get started, however, so it’s necessary to keep that in mind prior to needing to send money abroad. The last thing you’ll want is to be waiting to get approved or verified when you need to send money to a loved one, quickly. You may read many complaints online about remittance services related to delays in processing. This is often the number one reason, so please be prepared for this eventuality.

Xoom has lightened this load a bit by parterning with numerous large banks in the countries around the world. You can find their full navigable list in the partner locations section of the PayPal Xoom website.

A Special Note for those wishing to transfer funds to Japan

If you’re reading this review to see if Xoom might be a good option for sending money to Japan, you’ll be happy to know that as of of January 24, 2021, for example, The United States has 7024 locations to send and recieve money, Vietnam has 1758 money transfer locations, The Philippines has 74, and there are an astounding 100,211 money transfer locations in India. So, as you can see, partner locations matter when it comes to convenience.

Money sent from international locations outside Japan, arrive in your bank account in yen. Transactions can be accepted at any of these supported Japanese nation wide banks:

Aomori Bank, Ashikaga Bank, Awa Bank, Bank of Fukuoka, Bank of Kyoto, Bank of Okinawa Ltd., Bank of Tokyo Mitsubishi UFJ, Ltd., Bank of Yokohama, Ltd., Chiba Bank, Ltd., Hokkaido Bank, Ltd., Hokkoku Bank, Ltd., Hokuriku Bank, Ltd., Japan Post Bank Co., Ltd., Joyo Bank, Ltd., Mizuho Bank Ltd., Resona Bank, Ltd., Saitama Resona Bank Limited, Seven Bank Ltd., Shizuoka Bank, Ltd., SMBC Trust Bank, Sumitomo Mitsui Banking Corporation

2. Fees Comparable to other Remittance Companies

How doese a remittance cost to send using Paypal Xoom?

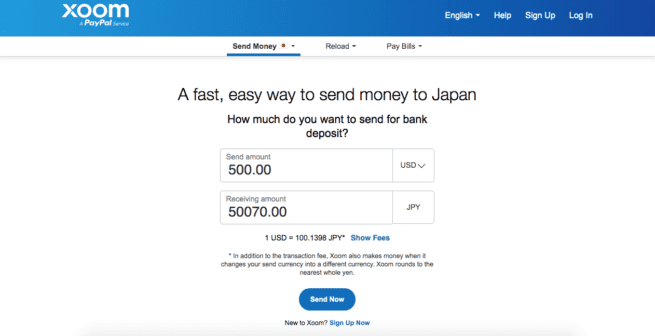

As of January 24, 2021, in USD: if transferring money using a PayPal balance or bank account, the fee is $9.99. Debit and credit card remittances are charged at $20.00 fee.

As stated on Xoom’s website, the company “also makes money when it changes your send currency into a different currency. Xoom rounds to the nearest whole yen.” (Source: Xoom)

The firm’s exchange rate generally fluctuates between 1-3% above the mid-market rate. So, this can make Xoom more expensive than other providers, particularly, Wise which does not make money on the exchange rate, charging only the mid-market rate without applying any markup.

3. Xoom’s Integration with PayPal

For some senders, the convenience of being able to use a PayPal balance to send an international money transfer is what forces their decision to use Xoom. But, given there are so many other options, that advantage hardly makes it a deal breaker.

3. What is Xoom’s Transfer Time? Is it Fast?

Like Western Union, international money transfers funded with cash, a bank account, credit or debit card, are often funded to your bank account within hours when sent Monday – Friday, midnight – 10 a.m., JST to all banks in Japan. (Source: Xoom)

3. Multiple Funding Options

Money can be sent to Japan, for example, using CAN, EUR, GBP, USD currencies (this includes credit and debit payments as well as a PayPal balance) and cash can be delivered on pickup within Japan.

Funding options differ depending on the country in which you live, but the ability to send money in a variety of currencies using cash, so it can be received as cash is one advantage to using Xoom over Wise, if that is a preferred option.

For many years, Xoom was my only resource for paying freelancers who lived overseas. I found it to be reliable, although costly. At the time, given there were no other options I was aware of, though, it was a fit.

These days, given the rise of TransferWise (now, Wise) and their no fee transfers, I’m exclusively using Wise for all my money transfer needs.

Your decision, will of course depend on where you live, what currencies are available to you, and the speed in which you need to deliver your money, just to name a few things you need to be aware of.

P.S. And, don’t forget verification takes a while, so if you think you MIGHT have a need in the future to use Xoom, it’s best to get started and sign up today so you don’t get caught in the waiting game just when you need to send money fast.

Good luck!

Often the fastest money transfer you can get. Fees are a little bit more than others, but if speed is your concern, you likely can’t beat Xoom. Send as little as $10 USD. Pay bills, and send money to friends and family even if they don’t use Xoom.

Want more of Nihon Hustle? Visit these reader favorites!